Health plan options can meet graduate needs

December 9, 2009

Emma Dejong

As fall graduates leave SDSU, the prospect of entering “the real world” can be exciting. However, with this excitement will come many responsibilities, including finding health insurance.

After graduation, some students will likely no longer be on their parents’ plan or a student plan.

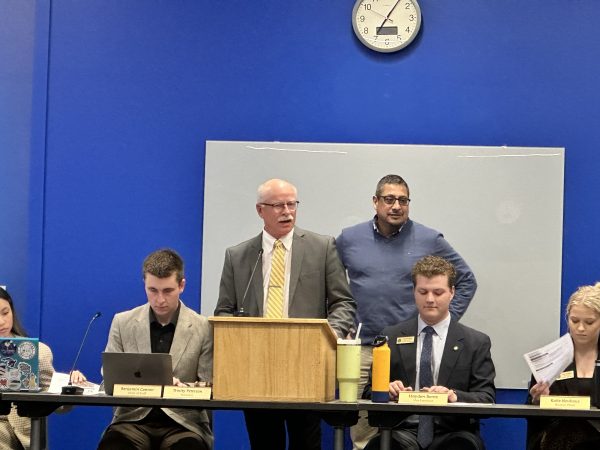

“The parents come in or the students come in after graduation, and they are in dire need of getting their own policy,” said Randy Suarez, a professional health insurance agent for locally owned Hawley Insurance Services.

Students should decide what coverage they need and then look at the various options available, Suarez said. Depending on where a student will be following graduation, every individual might need something different.

“If they graduate in December, hopefully they have positions they’re going to [that will provide them insurance],” said Karla Anderson, who works with SDSU’s insurance program. “Other than that, they can look at other plans in town.”

According to Suarez, many graduates would benefit from a short-term plan.

“There’s a short-term medical plan that is very, very reasonable,” he said. “It’s for people that are in-between jobs or people that are just graduated.”

This plan at Hawley Insurance Services offers between a $250 to $1000 deductible for up to six months. Other companies provide similar plans.

An option for current students who are not on their parents’ plan is SDSU’s health insurance plan, managed through Avera Health Plans.

“You can sign up for this plan either by the year or by the semester,” said Anderson, a program assistant with the Student Health Clinic and Counseling Services. “The students can apply for this online.”

With this program, students are required to report to the Student Health Clinic.

Another plan for students is Assurant Health’s Student Select, which is health insurance designed for college students. Unlike SDSU’s plan, Student Select is offered to students attending any accredited college or university and has no specified doctor or hospital users must choose.

Another difference is that Student Select does not necessarily end at graduation, as it is a renewable plan.

“Since Student Select is permanent, renewable coverage, you can continue to use it after you graduate,” said Rob Guilbert, vice president of Corporate Communications for Assurant Health. “However, it’s a good idea to work with an independent insurance agent to find the right health insurance coverage that best fits your needs, whether you’re a student or a new graduate.”

Analyzing all aspects of an insurance plan is important, Anderson said. Each individual should know what they need out of health insurance, and there is not one plan that works for everybody.

“I think they should definitely look over the benefits,” she said. “Just be careful what you see in the policy. Know what’s covered and what’s not covered.”