POET Commodity Trading Fund allows for hands-on trading experiences

South Dakota State University Ma

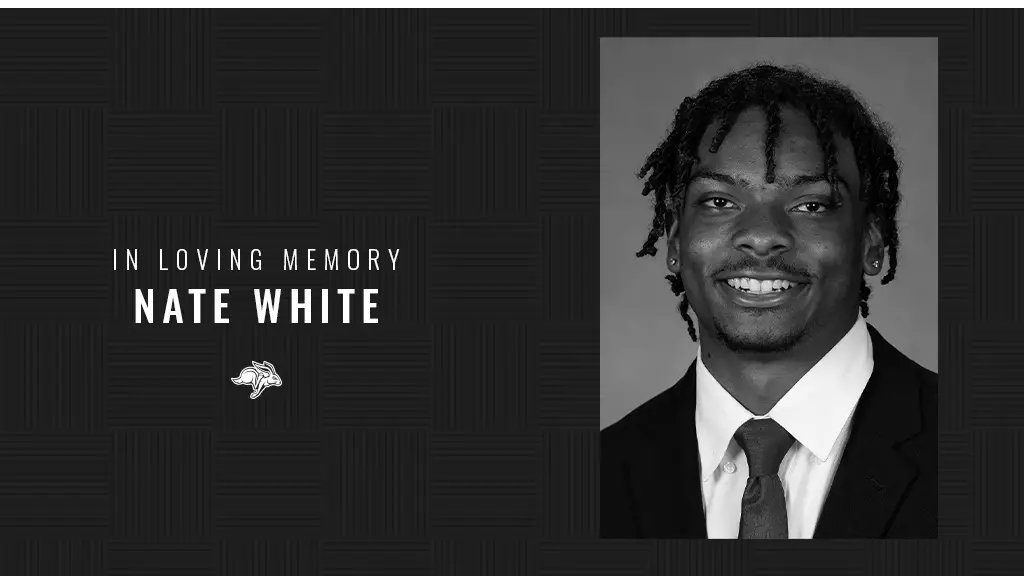

South Dakota State University Professor Matthew Diersen speaks to the agricultural futures and options class in Harding Hall. Thanks to the POET Commodity Trading Fund, the class’s 18 students get a real-world, hands-on trading experience.

April 18, 2019

The trading in agricultural futures and options class at South Dakota State University has a different feel this semester. Instead of students trading only via simulation or having to put up their own funds to make trades, the recently established POET Commodity Trading Fund allows the class’s 18 students to get real-world experience.

“POET is proud to be a part of this program,” said Jeff Broin, POET chairman and CEO. “Having the opportunity to trade with real dollars gives students a jumpstart in understanding the market that took me years of growing a commodity business to learn. I believe this will help SDSU graduates be more astute traders when they face real-world trading scenarios, whether at POET or another ag company.”

That knowledge took effect almost immediately, according to SDSU Professor Matthew Diersen.

“Compared to a year ago when they couldn’t trade for real, the students were much more aggressive in their suggestions that they’ve been so far this semester when there have been real dollars at stake. The psychology alone of doing something in real money versus paper money, it seems to have a subtle impact on their behavior,” Diersen said.

“The trades are limited to the semester timeframe, which limits the scale or scope of trades they make; there isn’t a minimum or maximum,” he continued. “Since they’re building a portfolio from scratch throughout the semester, they need to think how a new trade would impact the existing set of trades they have.”

Because the goal is to have future classes also make trades with the POET Commodity Trading Fund, there is pressure on the students to not lose its balance. Turner Blasius, a graduate student from Kimball, serves as the risk manager.

“I take a look at every serious trade that is brought up for consideration,” he said. “I make sure that we aren’t overexposing ourselves in one single trade or one single commodity. This way we can manage our risk and even if prices don’t go our way, we will still have money to operate throughout the semester.

“The best part of the class so far is just seeing how markets work and respond in so many different ways,” Blasius continued. “For example, markets can account for the price potential of a new trade agreement so it’s not always necessarily going to be as big of a price swing as you could think.”

Both Nathan Koehl and Lance Eide plan to take their class experience with them when they return to their family operations.

“If you want hands-on experience, this is the class,” said Koehl, a junior majoring in agricultural business from Morris, Minnesota. “Not only are you trading with real money, but you also have this person, Matt Diersen—who’s nearly an expert—to consult with, teach you and help you through it. I think this class is the best SDSU can provide because you’re trading on the commodity market with real money and also get to do some of your own trading on a program on your own time.”

Eide, a senior majoring in agricultural business from Clear Lake, said one of the toughest parts of the class has been holding positions after making a profit on them.

“It’s always enticing to buy or sell back the original trade after you’ve made some money on it,” he said. “Since I plan on going back to my family farm after graduation, I really want to know the ins and outs of trading. I plan on implementing hedging strategies as a producer, so I wanted to learn how to efficiently protect myself from any market moves.”

That information is what Diersen wants each student to walk away with when the class ends in May.

“We’re not sitting around trying outguess the market. We strategically think through the different characteristics of the commodities and apply them to the fund,” Diersen said. “It’s applying what they’ve learned up to this point about the different tools and techniques, bring them together and evaluate how did those positions work? Did the market move the way they expected it to? Did the particular strategy work the way it was supposed to work or the way the students had expected it to work?”

While Koehl admitted the class requires spending time reviewing and conducting research outside of the classroom, he’s glad he’s in the class.

“If you’re going to put time into any class, you’re going to get more out of it,” he said. “This is our last opportunity to learn before going out to do it on our own and when it’s our own money. As I said, this class is the best SDSU can provide.”