Graduates get kicked off parents’ plans

December 9, 2008

Julie Frank

Over 750 students will graduate from SDSU this December. Life after graduation offers a world of new opportunities students strive for: working at a full-time job, purchasing a house or starting a family. Unfortunately, not all of these new responsibilities are fun. School loans, along with other bills, need to be paid. In addition, some students will no longer qualify for their parents’ health insurance and need to purchase their own.

According to DakotaCare, the health care plan for the South Dakota State Medical Association, 61,000 South Dakotans do not have health coverage. A majority of the uninsured population are young people who often do not see the value in health insurance.

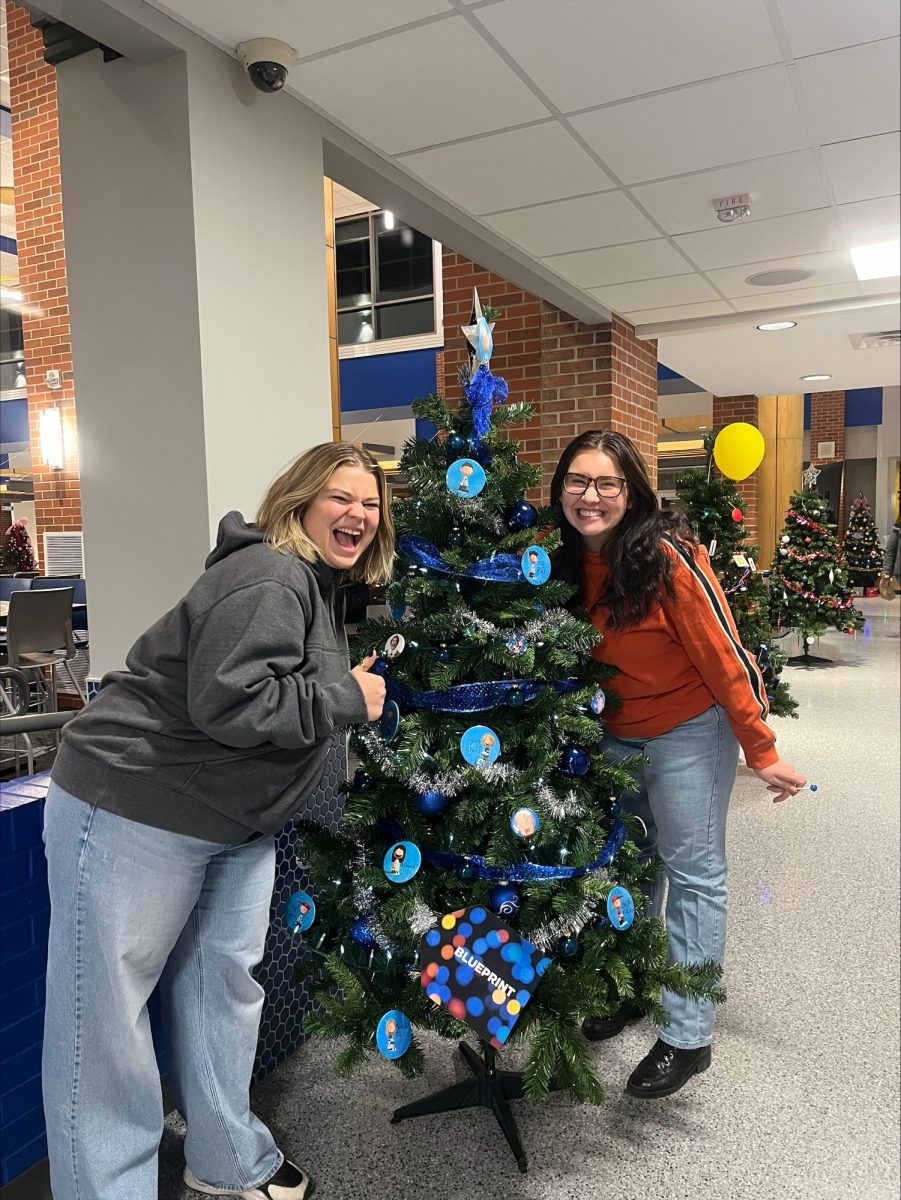

“I’m not looking forward to paying it on my own, but everyone has to have it,” Shasta Vearrier, a graduating journalism major, said. Vearrier knew she will no longer be eligible for her mom’s health insurance after graduation long before the start of the semester. She said she has never missed a class due to illness and does not plan to purchase health insurance until she finds a full-time job.

Unlike Vearrier, graduating communication studies and theater major, Katie Eisfeld, is looking for coverage immediately after graduation.

“I won’t go without it, because with my luck, my kidneys or appendix will burst,” she said. Eisfeld is interning at Daktronics beginning in January and has to look outside of the company for coverage. She added she is not worried about getting sick but about being covered in case of an accident.

“Everyone should have it,” Karla Anderson, a Student Health and Counseling Services program assistance, said. “It’s just that important.”

Anderson said graduates and students who suffer an illness or injury while uncovered can face heavy financial burdens without health coverage.

“Nobody anticipates those unfortunate events in our lives,” Kirk Zimmer, CEO of DakotaCare, said.

DakotaCare covers 130,000 people in South Dakota and nationwide. For the past two years, the company has provided DakotaCare One, an insurance plan aimed at individuals. Plans began as low as $70 a month.

According to Zimmer, recipients can apply for the insurance through an agent or online. The Internet option allows people to “shop” for plans that best suit them before submitting personal or financial information. Depending on their current health conditions, applicants can be approved immediately or within three days.

Zimmer added DakotaCare One can provide students between graduation and a full-time job with temporary coverage or a permanent solution.

However, students do not have to wait until graduation to get health insurance. SDSU students can purchase health insurance through the Board of Regents’ Avera Health Plans.

According to Anderson, the plan is aimed specifically at students and is a simple injury plan. Domestic students enrolled in five or more credits are eligible and can apply online. International students are required to have this health insurance before registering. With the plan, students receive a $200 deductible and have the option to buy by term (year or semester). Recipients’ ePay is automatically billed, and students may purchase the plan with scholarship or loan money.

Students with this insurance are required to report to Student Health with illnesses or injuries. For emergencies occurring outside of Student Health hours or for further treatments, students can be referred to other medical centers.

Anderson said between 400 and 500 students with the insurance plan visit Student Health each year.

No matter the insurance provider, Anderson said it is important for students to read the policy and know what it covers. In addition, Zimmer advises the purchase of health insurance that pertains to the individual to balance the amount of coverage with cost.